Navigating ESG and Regulatory Scrutiny in Receivables Finance in 2025

June 4, 2025

IMS Decimal Updates, Outsourced Accounting and Finance Services

Regulators are tightening the screws, investors are raising the bar, and clients are demanding transparency. Environmental, Social, and Governance (ESG) is no longer a checkbox; it’s a dealbreaker.

Only 36% of businesses feel confident about their finance operations being ESG-ready. Yet, receivables financing, often viewed as routine function, holds immense potential to advance environmental, social, and governance goals.

The evolution is real, from cloud-based automation that reduces paper waste to ethical collections aligned with social standards. Businesses are not just chasing margins anymore; they are chasing meaning. The shift is powered by ESG-aligned Accounts Receivable Services.

What is ESG?

ESG stands for Environmental, Social, and Governance. These three pillars reflect how responsibly a business operates.

Environmental considerations include carbon footprint, energy use, and waste management.

Social factors refer to employee wellbeing, diversity, and community impact.

Governance involves corporate ethics, board structure, and transparency.

Businesses today are expected to balance profit with purpose. That’s where environmental, social, and governance solutions come in.

Why ESG Matters in Finance?

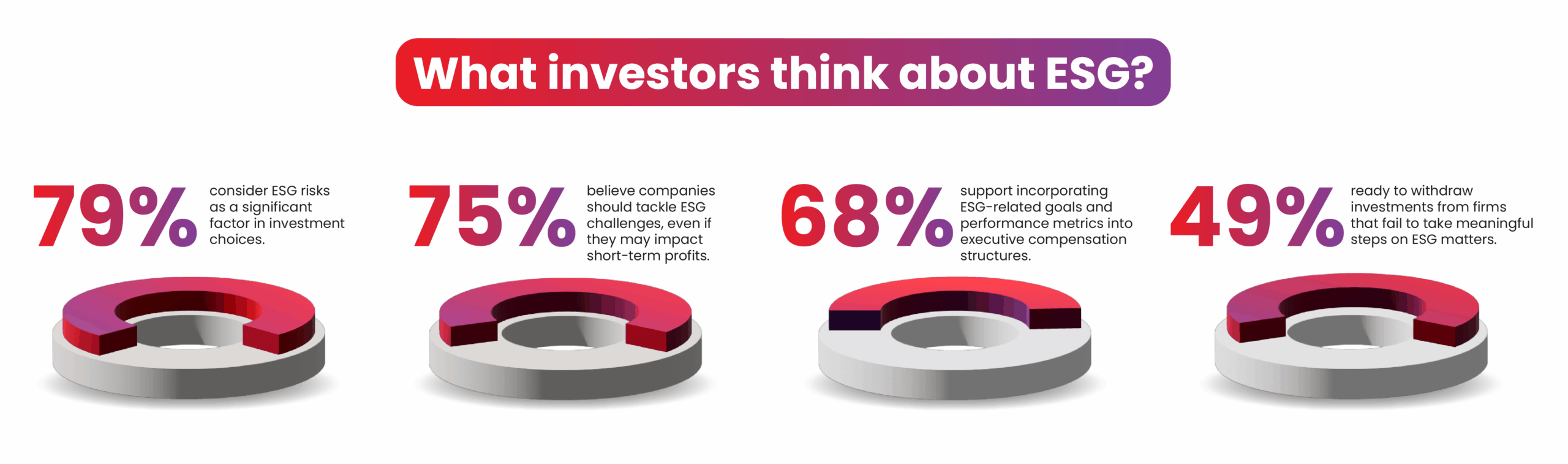

Finance drives business decisions, and ESG is becoming a key part of that process. Strong ESG practices reduce risk, build investor confidence, and enhance long-term resilience. Companies that adopt ESG principles tend to perform better over time. Investors, clients, and partners recognise a value-driven approach to growth.

How ESG is Reshaping Receivables Financing?

Receivables financing is being reimagined through the ESG lens. Transparency is no longer optional; it’s expected.

Clients want to work with ethical partners, regulators are looking for data-driven insights, and businesses necessitate financing that supports sustainability.

Technology also plays a vital role. Digital tools in outsourced receivables management make reporting and aligning with ESG metrics easier.

Regulatory Scrutiny and Compliance Expectations

Governments and regulators are increasing ESG oversight, especially in financial operations. The EU’s Corporate Sustainability Reporting Directive is one example. It mandates detailed environmental, social, and governance reports from companies.

Moving forward, businesses must report how they manage ESG risks while proving their claims. Failure to comply can lead to penalties and a loss of trust. That’s why many companies are turning to outsourced receivables management to stay compliant.

Why Outsourcing is Strategic for ESG-Aligned Finance Operations?

Outsourcing makes sense in this evolving landscape. It brings access to ESG expertise, technology, and faster implementation. With outsourced accounts receivable financing, companies can reduce their carbon footprint. Automated systems lower paper use, and cloud platforms provide real-time insights. Most importantly, outsourcing enables internal teams focus on core strategies, while experts handle the rest.

Aligning Accounts Receivable Services with ESG Objectives

The accounts receivable services can and should reflect business’s ESG values. That means using digital invoices, ensuring ethical debt collection, and maintaining transparency in communication.

It also means setting ESG-aligned goals. For example, reducing DSO (Days Sales Outstanding), while maintaining ethical practices. ESG isn’t just about what a business reports. It’s about how it operates.

ESG-Friendly Practices Across Receivables and Payables

To be truly ESG-aligned, both receivables and payables should work together. Paying suppliers on time matters. So does working with vendors who follow environmental, social and governance policies.

Using technology helps. Automation supports speed, accuracy, and less paper. That’s good for the environment, and for efficiency. Ultimately, receivables and payables management should support the sustainability journey.

Embedding Best Practices for Accounts Payable and Receivable

Best practices start with simple steps. Businesses should:

- Automate where possible.

- Audit processes regularly.

- Use digital tools to track performance.

- Set clear KPIs that align with ESG strategy.

- Communicate their expectations with teams and vendors.

Whether it’s accounts payable services or receivables, aim for ethical, consistent, and transparent practices.

ESG as a Driver for Receivables Innovation

ESG as a Driver for ESG is now a catalyst for innovation in finance. Especially in financing receivables. Businesses are exploring green financing. They are adopting tools that track ESG performance, and choosing partners based on shared ECG values.

ESG isn’t just a guideline – it’s the driving force behind future innovation.

Tech, Transparency, and Trust in Receivables Financing

Technology enables better ESG reporting, real-time dashboards, automated reconciliation, and secure digital records.

Transparency builds trust. Today’s clients and investors expect businesses to do the right thing and demonstrate it clearly. By integrating ESG tools into accounts receivable services, businesses build credibility and lasting partnerships.

ESG-Driven Lending and Financing Criteria

Banks and lenders now factor ESG into credit decisions. It’s not just about numbers anymore.

A strong environmental, social, and governance policy can improve access to capital. Lenders see it as a sign of reliability, and reduced risk. So, if a business is seeking receivables financing, the ESG credentials can make a real difference.

IMS Decimal: Your ESG-Aligned Accounts Receivables Back-Office Partner

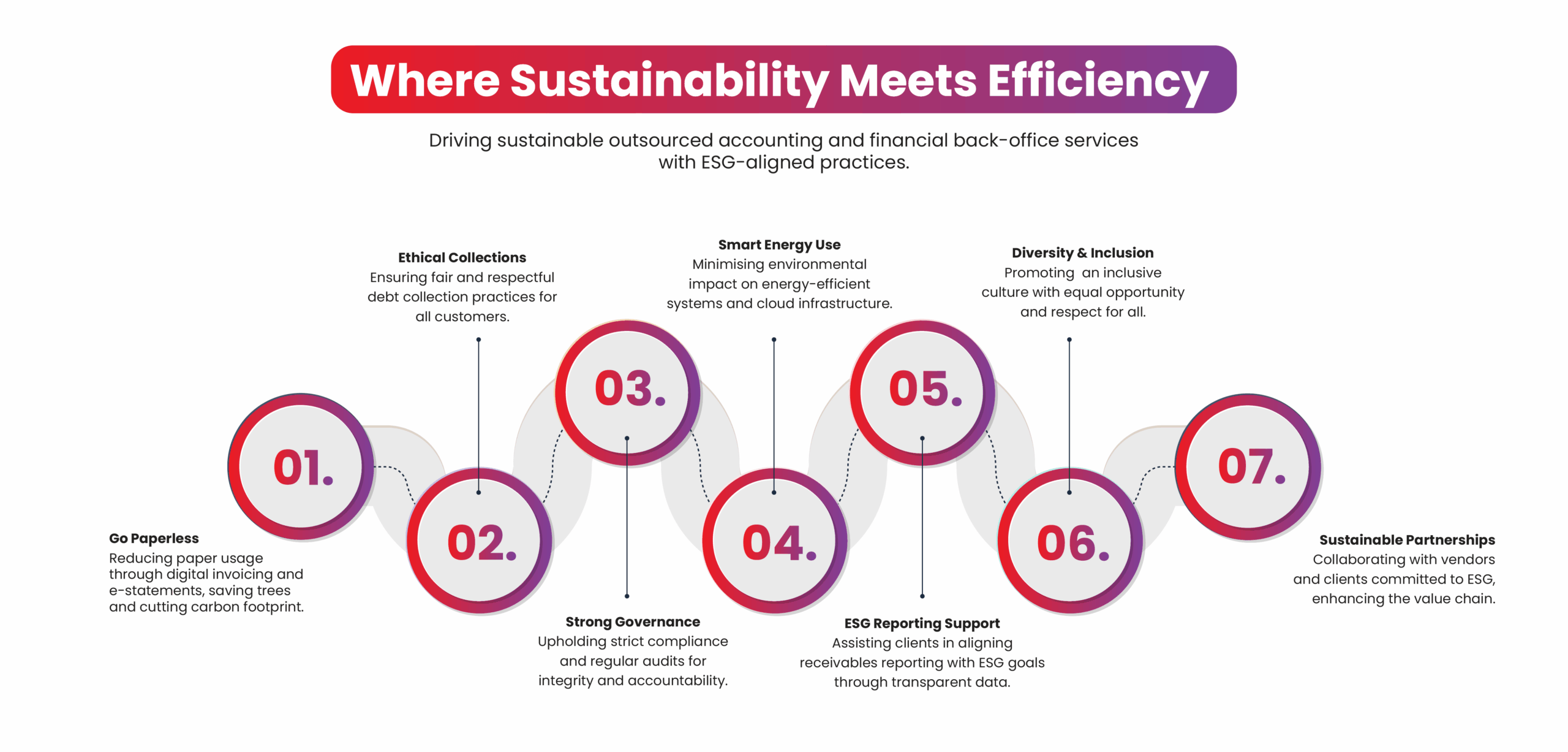

At IMS Decimal, as an outsourced accounting and financial back-office services provider, we understand the intersection of finance and sustainability. We offer outsourced accounts receivable services that are efficient, ethical, and ESG-compliant. Our tech-driven platforms ensure transparency at every step.

We don’t just manage receivables; we help you meet your ESG goals too. With our tech-driven, paperless, and ethically governed accounting back office, we align the financial operations with modern sustainability standards without adding complexity or cost.

Why Partner with Us?

- Proven expertise in outsourced accounts receivable financing

- ESG-conscious solutions tailored to your industry

- Transparent reporting and real-time analytics

- Integrated support for accounts payable and receivable management

At IMS Decimal, we don’t just deliver results; instead, we help businesses lead responsibly.